Content

To get a feel for the job—and to boost your resume—consider getting a summer internship. You’ll get hands-on experience and make connections that can help in your job search. Make a good resume that is customised to the position you desire.

Charles Schwab or Fidelity are two examples of discount brokers. If desired, students can work with academic advisors to choose the right supplementary classes for useful business, economics and finance skills. When applying for these positions, make sure to mention any training or sales experience you’ve had. You want the company to know you’re hiring someone who can assist them in successfully buying or selling properties. As an intern, you will have the opportunity to assist and work with senior agents who will teach you what it takes to succeed in their field.

Get the best brokers tailored to your needs

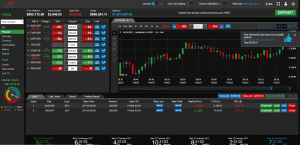

It’s much easier to have your charts and watchlists on one screen, and market news, articles, fundamentals, your trading platform, or any other tool that you’re using to trade on another screen. Besides the period of the day you choose to trade, some weekdays also offer better trading opportunities than others. Monday and Fridays tend to be the quietest days, with trading activity gradually picking up from Tuesday to Thursday. The best time to day trade depends mostly on your trading strategy.

How To Become A Stock Broker In The UK – Up the Gains https://t.co/OwNzCtdmxw

— Up the Gains (@upthegainsmoney) August 27, 2022

Dealing on Freetrade is commission-free irrespective of the subscription plan you choose. Freetrade’s suite of products includes a Stocks and Shares ISA, General Investment Account and SIPP. Robo advisors are technology companies that provide automated financial planning with little or no human supervision. Their products include ready-made investments, managed investments and financial advice.

Finance Officers

Buyers and sellers are generally recommended to contact a certified real estate professional to define an individual state’s agency law. In addition, many states require documented statements summarising the obligations and responsibilities to be signed by all parties. Real estate agents are typically paid entirely by a commission—a percentage of the property’s purchase price. So their income is contingent on their ability to close a deal..

We need a strict plan to trade the market, and we only enter into a trade when all rules of our plan align. Consider risking only up to 2% of your trading account per any single trade. As you gain experience and become a better trader, you can start to increase your risk on certain high-probability setups . Day traders have a variety of trading strategies at their disposal. Here’s a list of the most popular ones, but bear in mind that you need to create your own trading rules that suit your risk profile and trading plan to become a successful trader. You can’t just copy and paste a trading strategy and expect to become profitable.

The offer of real estate as such, without any collateral arrangements with the seller or others, does not involve the offer of a security. When the real estate is offered in conjunction with certain services, however, it may constitute an investment contract, and thus, a security. See generally, Securities Act Release No. 5347 (Jan. 4, 1973) . Firms that run a matched book of repurchase agreements or other stock loans are considered dealers.

Do you need a degree to be a stockbroker?

See below for three common courses in finance and business graduate programs. Keep in mind that programs may not offer all of these courses. Before enrolling, prospective students should consult with a school’s admissions department and review course descriptions.

Plenty of people trade, but the more time you spend studying trading, the more you practice, – as with everything else -, the better results you can expect. Knowing yourself, your attitude to risk-taking, and being patient and disciplined are also crucial factors if you want to be successful. Keep a cool head, don’t look for easy money, commit to studying trading and always have a trading plan. Our aim is to make personal investing as clear and accessible for you, as possible.

To pass, students must answer at least 90 questions correctly. The Series 7 license allows the holder to sell securities, but not futures and commodities. This license is also known as the General Securities Representative Qualification how to become a stockbroker uk Examination. Many individuals who work in the financial planning field take this exam before earning additional certifications. But to earn admission to a bachelor’s program, individuals need a high school diploma.

Overview of the best brokers for beginners

Both index funds and ETFs offer significant diversification benefits and have very low fees ranging from 0.05% to 1.00% of the total value of your investment portfolio. The Moneybox app also empowers you to invest your spare change by rounding up your card transactions to the nearest pound and investing the difference on your behalf. For example, if you spend £2.30 on a snack, Moneybox will invest 70p for you. You can also instruct the app to make weekly or one-off deposits into your investment portfolio as it rounds up your spare change.

People often ask how much money can be made in the stock market. On average, the value of your investment could rise by about % a year depending on a number of factors, but there are no guarantees. If you like the thought of working for the firm that facilitates more trades than any broker in the world but still fosters the atmosphere of an energetic start-up, find your role at Interactive Brokers today. In general, getting a license without professional help is not easy in any Forex regulation.

Career Outlook for Stockbrokers

11 Rules 17a-2, 17a-7, 17a-8, 17a-10 and 17a-13 contain additional recordkeeping and reporting requirements that apply to broker-dealers. Monthly account statements showing the market value of each penny stock held in the customer’s account. The duty of best execution, which also stems from the Act’s antifraud provisions, requires a broker-dealer to seek to obtain the most favorable terms available under the circumstances for its customer orders. This applies whether the broker-dealer is acting as agent or as principal.

- Without a degree, you’ll need to make sure that you’re fully certified, licensed, and registered to work in the securities industry.

- Beginner investors with little money can start by investing for the long term in low-cost global or total-market index funds and ETFs.

- For starters, you can join a Toastmasters club, take public speaking classes, or read some books on this topic.

- Additionally, the first £2,000 you receive in dividends is tax-free.

- At My Trading Skills, we offer these trading courses led by expert traders.

It offers tens of thousands of regulated financial instruments that enable investors to diversify their portfolios worldwide. Moneyfarm’s customers benefit from free and personalised digital financial advice from Moneyfarm’s investment consultants, and you can chat, phone, email, or meet your consultant in person. To get started, you will be asked to complete a short survey so that Moneyfarm can better understand how you approach your finances before matching you to your investment portfolio and consultant.

However, if you can hold on to your investments even when the market takes a hit, things should improve in the following years, but there are no guarantees. If you prefer to invest in a ready-made portfolio, eToro has over 40 fully allocated, balanced investment portfolios, focusing on market segments you can understand and to which you can relate. Some of the portfolios include MetaverseLife, BigTech, GoldWorldWide, Vaccine-Med, BitcoinWorldWide, Diabetes-Med, Driverless, GigEconomy, and many more. These portfolios are a grouping of several assets, such as stocks, cryptocurrencies, ETFs, and even people, bundled together based on a predetermined theme or strategy. With Freetrade, you can invest in fractional shares of even the most expensive US shares with as little as £2. Depositing, trading and withdrawing on Freetrade are commission-free .

I. Privacy of Consumer Financial Information (Regulation S-P)

The STA provides educational and lobbying resources for its members. On average, full-time learners need two years to complete a master’s degree. An insurance broker in the US earns about $76,000 to $107,000 annually, according to the employee compensation data platform Salary.com.

United Kingdom

This is true for those who seek employment in firms or choose to work on their own. With a degree in international business, a person gains a broader knowledge of international business principles, finance with an international focus and global economy issues. These are all important to know for working with international markets. For those who are looking to expand and offer more services than competitors, this can be highly advantageous.

Most offshore locations are on islands in the Pacific, the Indian Ocean, and the Caribbean. Classic examples of offshore countries are Belize, Guyana, Suriname, and others. The fee for obtaining a license in such Forex regulations can be as low as several thousand euros. Another distinctive feature of offshore jurisdictions is that obtaining a license does not require a preliminary audit.

Half-time students take about six credit hours per term, and full-time students take 12 credit hours per term. As a full-time student, it typically takes almost four years to finish a degree https://xcritical.com/ program without any transfer credits or CLEP credits. Although some schools offer business management or business administration degrees, others offer general business degree paths.